I’ll skip the intro about how famous and beautiful Apple is. We all have had AT LEAST one Apple product in our life so you already know what is it about.

What is interesting is that Apple is the biggest company in the world and is being valued, as of December ‘22, at more than $2.5 trillion. In 2021 alone, it made $365 billion in revenues.

Where is that money coming from? Easy guess: physical products, like the iPhone you are using to read this article. But there's also this tiny thing called Apple Services that includes Apple Care, Appstore, and so on, which weighs about 20% of the total revenues and is the second-largest income stream for Apple.

But again, why do we care? Let’s use the words of one of the most influential people in the world, Elon Musk:

By saying that Apple is retaining a 30% tax on everything you buy through the Appstore, it means everything (yeah ok, excluding physical products. Lucky you, Amazon). The so-called in-app purchases.

That's why, if you are using Netflix (without stealing it from your ex), you may have noticed that you cannot buy the subscription from the iOS app itself. Or, if you're into Crypto, you may have noticed that Coinbase Wallet disabled NFT transfers in its iOS app.

And here’s the fun: for NFT transfers, the Apple tax is on the gas fee. But neither the sender nor the recipient actually receives the gas fee. Using Coinbase’s own words, it would be like ‘Apple trying to take a cut out of every email sent over open Internet protocols.’

Gas fees, also called transaction fees, are the fees you pay to execute any transactions on the blockchain.

It’s going to take time, even more after the fall of FTX, but we will live in a Crypto-oriented world. Or at least this is my view.

Apple is making its users unable to conduct crypto transactions. And they count for about 56% of the total smartphone owners. So IT IS a big deal.

If things remain as is (very unlikely), it’ll all come down to a ‘who has it longer’ competition between Apple and Crypto. While now Apple has more leverage to impose its will, in the long run, I don't see it as a sustainable approach since Crypto is a technology, not a company. And the value of a technology is defined by its adoption.

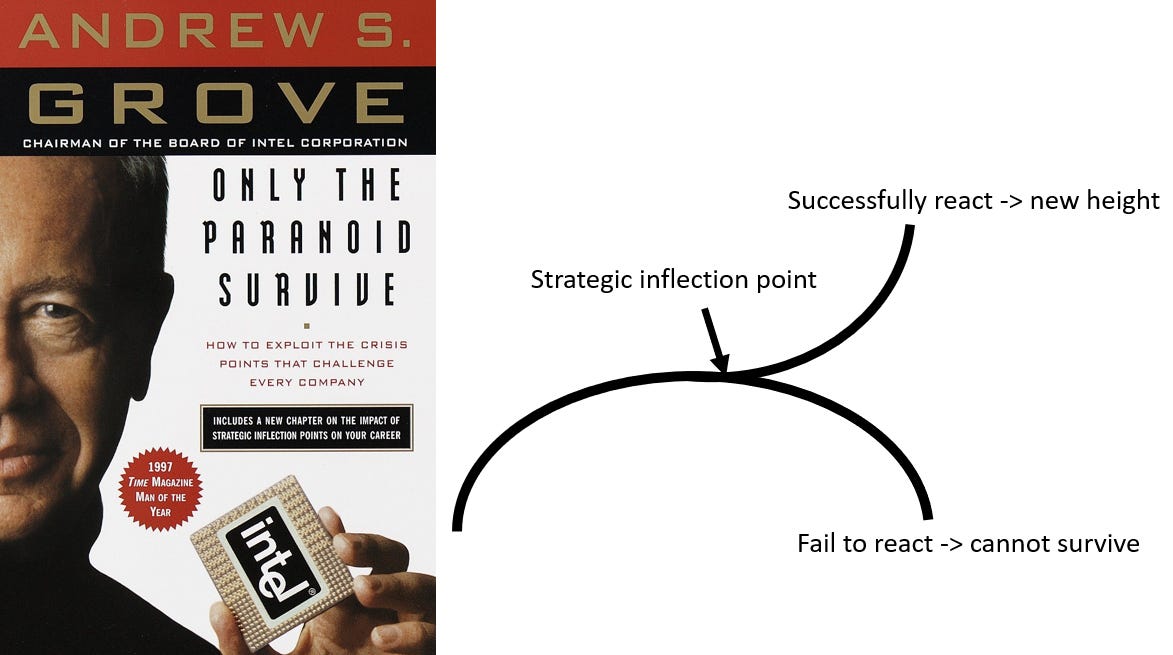

Andy Grove, founder and former CEO of Intel, in his book ‘Only the paranoids survive’ defines the Strategic Inflection Point as when a company faces a massive change due to external factors (such as new technologies, like crypto) and must adapt as quickly as possible, or fall by the wayside.

And, sure, it’s very unlikely that the world's main phone producer will fail for not adapting to Strategic Inflection Points… *cough* Nokia *cough*

Ok, maybe I took it too far. But you get the point. As someone very lazy once said, let’s sit, relax, scroll our brand-new iPhone and watch how it unfolds. On an iOS app.

Thanks for reading! If you liked it, subscribe to the newsletter Tales of an Ignorant.

amazing insight!!