If you are into the Crypto or financial world, by now you should know how shitty these last two weeks have been. If you are not, then continue scrolling.

The beginning:

There was this guy called Sam Bankman-Fried (SBF). One month ago he was considered a genius. The t-shirt and shitty car kind of genius. Moreover, his dream was to become rich in order to help the poor - and he did, actually becoming one of the top 100 richest people in the world, being worth $15.6B at some point.

In the image: Sam Bankman-Fried aka SBF

How did he do it? In 2017, he founded Alameda Research. In short, Alameda bought Bitcoin in the US for some price and sold it in Japan for a higher price. It’s called arbitrage. He made around $20M this way. Totally legal and super smart.

Two years later he then proceeded by founding a crypto exchange, called FTX. An exchange is a middleman that allows people to buy and sell their assets. It makes money by charging a commission and it does NOT own or invest users’ money. A bank does (important later).

FTX did extremely well. It became the second biggest crypto exchange in the world (after Binance), making $1.02B in revenue in 2021 only, with more than 1M users worldwide. To give you a grasp of its reach, the Miami Heats stadium was renamed the FTX arena. We’re talking real mainstream reach.

In the image: the FTX arena

It’s pretty standard for an exchange as big as FTX to mint its own token called $FTT. The idea of a token is to pump-up revenues by selling it to people that believe in the project or simply want rewards by owning it.

So far so good.

The mess-up:

2022 is a shitty year for whatever market you’re into. Wherever you put your money, you’re losing. If you’re putting money in solid assets, you’re losing moderately. But if you’re exposed to a volatile market, you’re losing BIG. And crypto is THE volatile market.

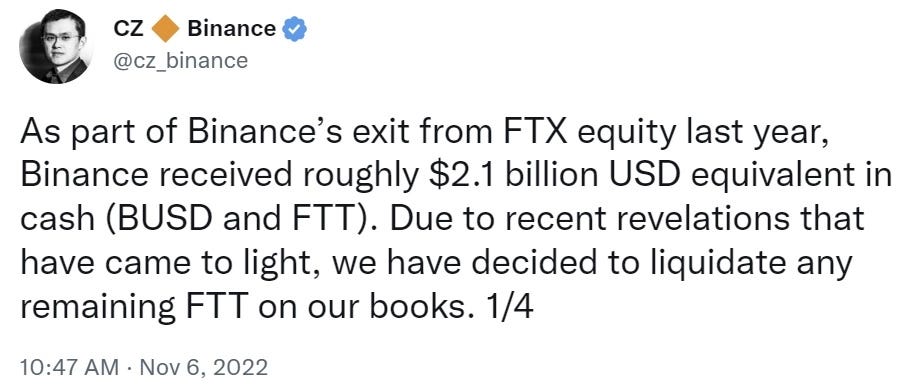

Binance, the main world crypto exchange, was one of the first investors in FTX and owned some $FTT. Here’s what happened:

FTX is obviously the major owner of $FTT. You have money invested into FTX. You read this tweet, what do you do? Of course, you take them off. The transaction amount on that day counted for $4B(!) But FTX is not a bank so it should have your money ready for withdrawals.

It didn’t. (the reason is explained below)

$FTT price is dropping, people are losing life-savings in a matter of hours without being able to withdraw them. Fuck.

Go to sleep, wake up. See this:

Binance, the main competitor, is acquiring FTX? The same Binance that caused it? This is some chess-like move we don’t see very often. Or at least it seemed so.

And it wasn’t.

After due diligence, Binance found a $6.7B insolvency hole within FTX. It obviously backed off the deal causing FTX to officially declare bankruptcy.

All the FTX users lost their money.

Why it happened:

Coindesk, one of the main crypto news site, reports on November 2nd that Alameda research, the same Alameda that SBF founded, owned $14.6B in assets - but most of them were in $FTT. This is the reason why Binance decided to drop their own $FTT on November 6th, causing this turmoil.

It turned out that $FTT was taken from FTX’s users and injected into Alameda to cover their risky investments. Problem is that, due to the shitty market, the money lended couldn’t be repaid.

But it wasn’t a problem as long as FTX continued to make money to inject again. Bell’s ringing? Yes, a Ponzi scheme.

The system collapsed after the Binance tweet caused $FTT to drop 80% of its value, which was used to cover the risky bets made by Alameda, breaking officially this twisted wheel.

What now?:

Well, $370M funds were hacked from FTX the day after declaring bankruptcy.

Other exchanges are requested to prove they actually have the money by showing their wallet balance.

But what if I send you the money, you take the screenshot to prove everything is ok, and then send the money back? Lots of dirt is coming up, stay tuned…

You’d be thinking, at least SBF is going to jail. Well… not really.

He will be speaking at the next NYT summit on November 30th. Want to attend? $2499, thanks.

Thanks for reading, hope you enjoyed and learned something new. If not, at least I did.

If you liked it, subscribe to my weekly newsletter Tales of an Ignorant, and win some amazing thank-you emails!

Thank you Daniel, you explained perfectly!

Very well explained! Thanks Daniel!